Visa Invests in Moniepoint to Propel Financial Inclusion Across Africa

Moniepoint Inc., a prominent business payments and banking services platform in Nigeria, has secured a significant investment from Visa, the global leader in digital payments. This partnership underscores Visa’s commitment to promoting financial inclusion and enhancing the digital payment ecosystem, particularly for small and medium-sized enterprises (SMEs) across Africa.

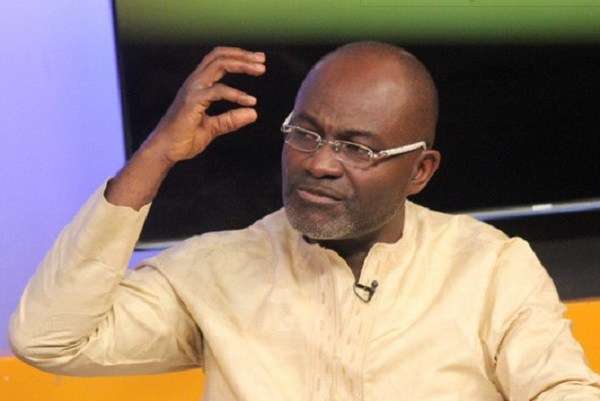

Founded in 2015 by Tosin Eniolorunda and Felix Ike, Moniepoint has emerged as a key player in offering integrated financial solutions tailored for Nigeria’s extensive network of SMEs. The platform, which was previously known as TeamApt Inc., provides a range of services, including digital payments, banking, credit, and management tools. Moniepoint processes over 1 billion transactions each month, with a total payment volume exceeding $22 billion, thereby empowering businesses to digitize operations and thrive in the rapidly changing African economic landscape.

With Visa’s investment, Moniepoint intends to accelerate its mission to empower African businesses, further expanding its reach and impact across the continent. Moniepoint’s effective and scalable business model, coupled with its strong operational and financial performance, positions it as a transformative entity in the African fintech space.

The financial landscape in Africa is rapidly evolving, driven by an upward trend in fintech innovation aimed at bridging the financial inclusion gap. Visa, with its extensive expertise and resources, has played a pivotal role in supporting the growth of African fintech startups.

Tosin Eniolorunda, Founder and Group CEO of Moniepoint Inc., expressed enthusiasm about the investment, stating, “Visa’s backing is a strong endorsement of our vision to digitize and support African businesses at scale. Together, we aim to deepen financial inclusion, enabling SMEs to access the tools and resources they need to thrive in an increasingly digital economy.” Eniolorunda highlighted the necessity of widening access to the formal financial system, especially considering that around 83% of employment in Africa is concentrated in the informal economy.

Andrew Torre, Regional President of Visa for Central and Eastern Europe, the Middle East, and Africa, highlighted the potential of this partnership: “By enhancing financial services and digital payment infrastructure, we are excited to support Moniepoint’s next phase of growth and innovation, facilitating a more inclusive and dynamic financial ecosystem throughout Africa.”

Moniepoint’s growth trajectory has been impressive, boasting a revenue increase exceeding 150% CAGR in recent years. The company’s mission to enhance access to financial services aligns seamlessly with Visa’s goal of enabling economic prosperity for individuals and businesses globally.

This partnership represents a unique melding of Moniepoint’s local insights and innovative approach with Visa’s global capabilities. Together, they aspire to drive the digital transformation of African SMEs, leading to greater financial inclusion and enduring economic growth.

Visa joins an esteemed list of investors in Moniepoint, including Development Partners International, Google’s Africa Investment Fund, Verod Capital, Lightrock, QED Investors, Novastar Ventures, British International Investment (BII), FMO, Global Ventures, and Endeavor Catalyst, all contributing to Moniepoint’s vision of achieving financial happiness for all.